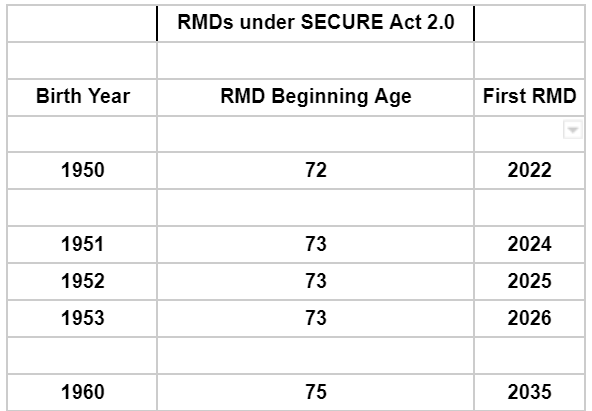

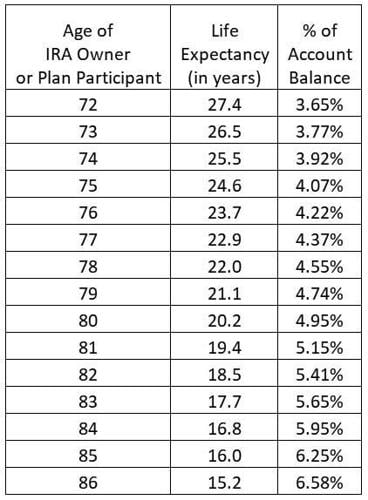

2024 Rmd Table – You turn 74 in 2024. Using the correlating IRS table, your distribution period is 25.5 and your required minimum distribution for 2024 would be $7,843 ($200,000 ÷ 25.5). You can always withdraw m . If you retire in 2024, the tax code allows you to take your Required Minimum Distribution in 2024 but it is not required. .

2024 Rmd Table

Source : www.ubt.com

Calculating Required Minimum Distributions

Source : www.canbyfinancial.com

IRS Notice 2023 54 Provides Relief, Guidance Regarding RMDs

Source : www.kitces.com

RMD Changes Woods CPA

Source : woodscpa.net

New life expectancy tables affect RMDs | Union Bank & Trust

Source : www.ubt.com

What new IRA distribution tables mean for you | Business

Source : www.thenewsenterprise.com

New Guidelines For Your Required Minimum Distributions (RMD

Source : www.paulried.com

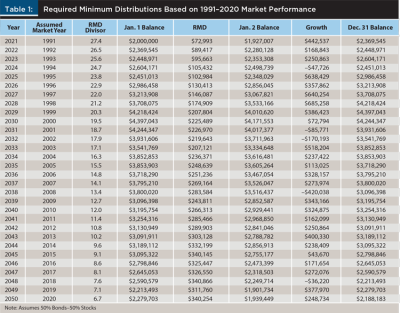

Required Minimum Distributions as a Retirement Strategy

Source : www.financialplanningassociation.org

IRA Required Minimum Distributions Table 2023 2024 | Bankrate

Source : www.bankrate.com

IRA Required Minimum Distributions Table 2024 | SmartAsset

Source : smartasset.com

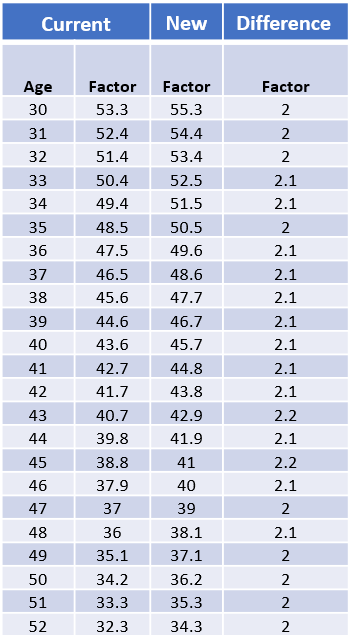

2024 Rmd Table New life expectancy tables affect RMDs | Union Bank & Trust: Opinions expressed by Forbes Contributors are their own. I write about investing, retirement, & workplace savings plans. For the first time since 2012 the IRS has updated the life expectancy . Technically, that means the RMD must start being withdrawn no later by the estimated remaining years of your lifetime, in a table provided by the IRS. The table shown below is the Uniform .